Menu

Client

China Construction Bank

2022 Spring

Role

User Interface Designer

Teammates

Key. Chan

Project Director

Xin. Gao

UX Expert

Kun. Lin

Senior UI

Luyuan. L

Senior UX

Syuham

UI

Amy. Yao

UI

Background

At the end of 2021, CCB established a consumer finance company, which needs to build an online financial consumer platform from scratch to provide a better financial service experience for young people.

At the end of 2021, CCB established a consumer finance company, which needs to build an online financial consumer platform from scratch to provide a better financial service experience for young people.

Clients goal

Develop a unique product and experience tailored for young people, differentiating it from traditional financial offerings in the market and infusing the financial product with a variety of interactive experiences.

Develop a unique product and experience tailored for young people, differentiating it from traditional financial offerings in the market and infusing the financial product with a variety of interactive experiences.

Areas of Focus

What is clients's resource expectation?

How to determine a product design direction based on target users?

How to alleviate users's apprehension towards borrowing service?

What can make client's financial lending platform stand out?

Contribution

Conduct inspiration and research on potential innovative features based on identified opportunities

Establish the overall brand language and tone of the product, ensuring consistent product design. (Concept of design, Design system)

Design core pages for both mobile and brand business website.

Assisting team members in completing the visual design of workflow pages.

Coordinate with developers for the delivery of documentation

Texture & Atmosphere

The frosted glass texture, harmonizing with a gradient from cool to warm tones, complemented by vibrant color accents, creates a balanced sense of rhythm

Where the ethereal meets the tangible, a tranquil breath emerges. In a palette where coolness prevails and warmth whispers, it evokes the serene yet tender embrace of dawn's first light.

Texture & Atmosphere

The frosted glass texture, harmonizing with a gradient from cool to warm tones, complemented by vibrant color accents, creates a balanced sense of rhythm

Where the ethereal meets the tangible, a tranquil breath emerges. In a palette where coolness prevails and warmth whispers, it evokes the serene yet tender embrace of dawn's first light.

Texture & Atmosphere

The frosted glass texture, harmonizing with a gradient from cool to warm tones, complemented by vibrant color accents, creates a balanced sense of rhythm

Where the ethereal meets the tangible, a tranquil breath emerges. In a palette where coolness prevails and warmth whispers, it evokes the serene yet tender embrace of dawn's first light.

Texture & Atmosphere

The frosted glass texture, harmonizing with a gradient from cool to warm tones, complemented by vibrant color accents, creates a balanced sense of rhythm

Where the ethereal meets the tangible, a tranquil breath emerges. In a palette where coolness prevails and warmth whispers, it evokes the serene yet tender embrace of dawn's first light.

Future is connection

We have introduced digital IP technology accompanies users through the entire process. Creating a sense of companionship.

Future is connection

We have introduced digital IP technology accompanies users through the entire process. Creating a sense of companionship.

Future is connection

We have introduced digital IP technology accompanies users through the entire process. Creating a sense of companionship.

Future is connection

We have introduced digital IP technology accompanies users through the entire process. Creating a sense of companionship.

One-stop platform

Embed shopping and trend-setting scenarios to enhance user engagement, strengthening the connection between borrowing and consumption

One-stop platform

Embed shopping and trend-setting scenarios to enhance user engagement, strengthening the connection between borrowing and consumption

One-stop platform

Embed shopping and trend-setting scenarios to enhance user engagement, strengthening the connection between borrowing and consumption

One-stop platform

Embed shopping and trend-setting scenarios to enhance user engagement, strengthening the connection between borrowing and consumption

Simply and Timely

Utilize a progress bar to set psychological expectations for users, providing prompts at each step and encouraging completion. Reduce user operation costs and provide positive guidance to users. Minimizing the anxiety caused by complex application steps

Simply and Timely

Utilize a progress bar to set psychological expectations for users, providing prompts at each step and encouraging completion. Reduce user operation costs and provide positive guidance to users. Minimizing the anxiety caused by complex application steps

Simply and Timely

Utilize a progress bar to set psychological expectations for users, providing prompts at each step and encouraging completion. Reduce user operation costs and provide positive guidance to users. Minimizing the anxiety caused by complex application steps

Simply and Timely

Utilize a progress bar to set psychological expectations for users, providing prompts at each step and encouraging completion. Reduce user operation costs and provide positive guidance to users. Minimizing the anxiety caused by complex application steps

Visualize Your Spending

By using an IP to remind users of their bill status and provide credit limit usage tips, guiding responsible spending and reducing anxiety over bill management.

Visualize Your Spending

By using an IP to remind users of their bill status and provide credit limit usage tips, guiding responsible spending and reducing anxiety over bill management.

Visualize Your Spending

By using an IP to remind users of their bill status and provide credit limit usage tips, guiding responsible spending and reducing anxiety over bill management.

Visualize Your Spending

By using an IP to remind users of their bill status and provide credit limit usage tips, guiding responsible spending and reducing anxiety over bill management.

Message center

A pull-down gesture leads users to the Message Center, organized visually to prioritize important updates and promotions. The use of gentle color schemes and interactive IP elements engages users to stay informed about account details.

Message center

A pull-down gesture leads users to the Message Center, organized visually to prioritize important updates and promotions. The use of gentle color schemes and interactive IP elements engages users to stay informed about account details.

Message center

A pull-down gesture leads users to the Message Center, organized visually to prioritize important updates and promotions. The use of gentle color schemes and interactive IP elements engages users to stay informed about account details.

Message center

A pull-down gesture leads users to the Message Center, organized visually to prioritize important updates and promotions. The use of gentle color schemes and interactive IP elements engages users to stay informed about account details.

Consumer Personality Test

Instead of dry financial education articles, we utilize a more gamified approach to assess spending capabilities in a manner more appealing to younger audiences. This method not only guides users towards responsible use of consumer loans but also enhances the product's shareability on social media platforms

Consumer Personality Test

Instead of dry financial education articles, we utilize a more gamified approach to assess spending capabilities in a manner more appealing to younger audiences. This method not only guides users towards responsible use of consumer loans but also enhances the product's shareability on social media platforms

Consumer Personality Test

Instead of dry financial education articles, we utilize a more gamified approach to assess spending capabilities in a manner more appealing to younger audiences. This method not only guides users towards responsible use of consumer loans but also enhances the product's shareability on social media platforms

Consumer Personality Test

Instead of dry financial education articles, we utilize a more gamified approach to assess spending capabilities in a manner more appealing to younger audiences. This method not only guides users towards responsible use of consumer loans but also enhances the product's shareability on social media platforms

Business Website

I have also designed a corporate website for CCB and developed a core component library along with usage documentation. These resources are intended to assist CCB in maintaining consistency in its design language during future product iterations

Process

Process

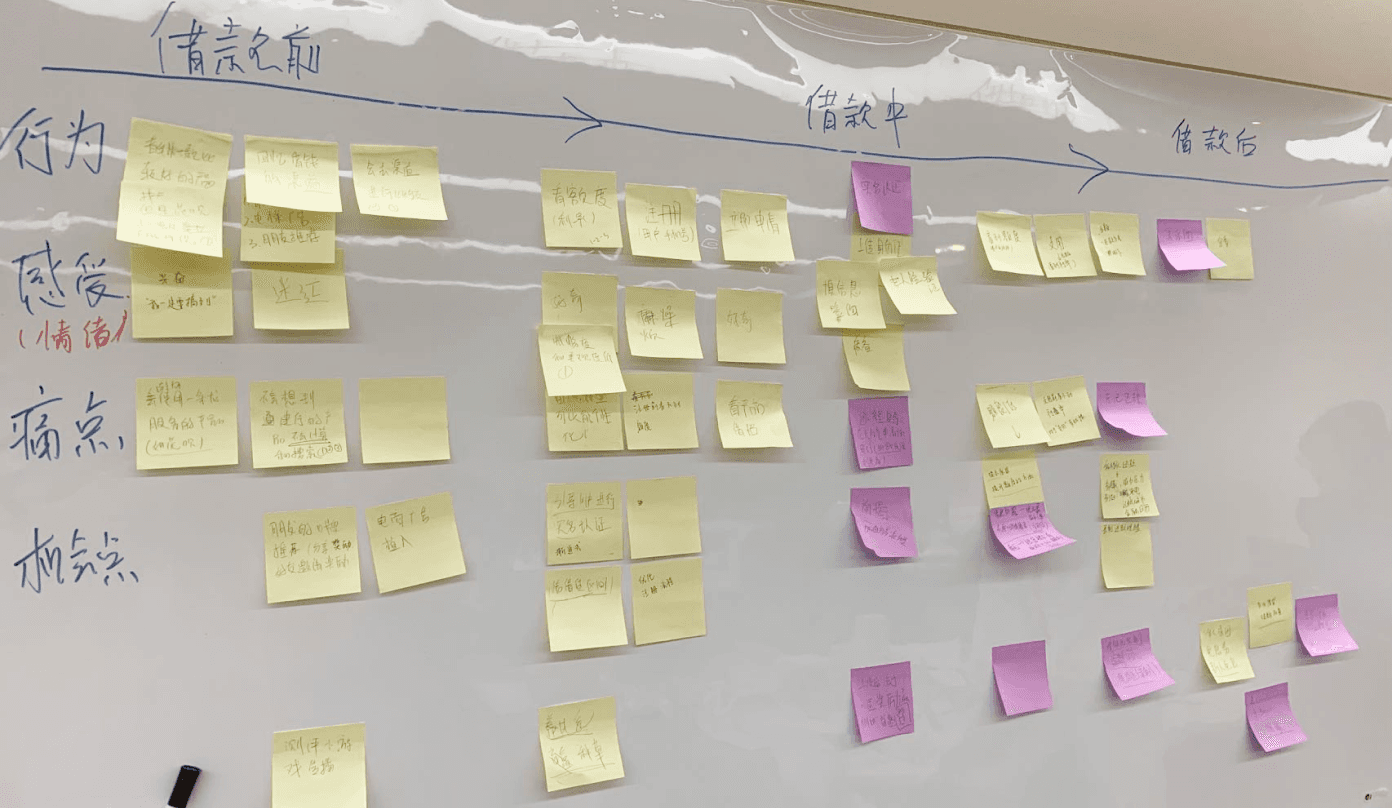

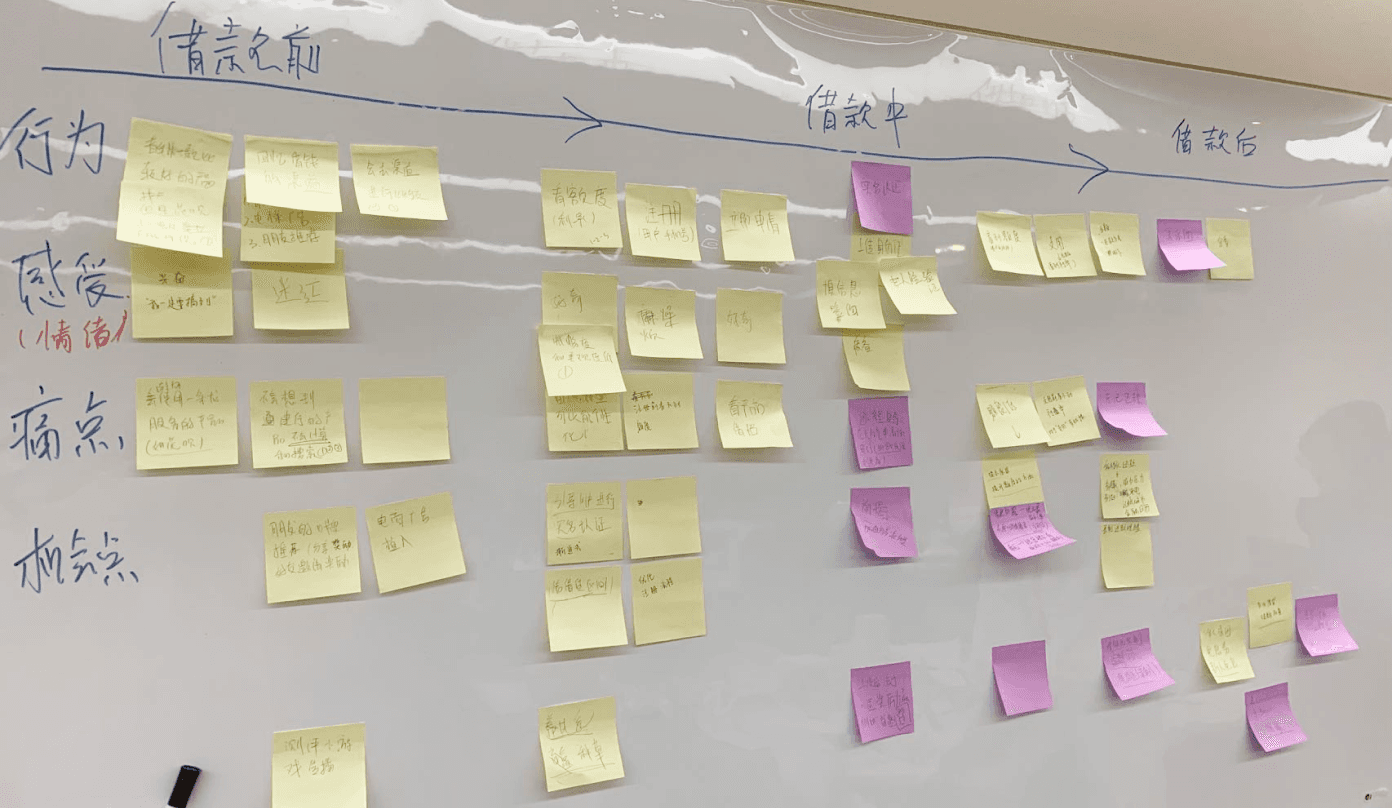

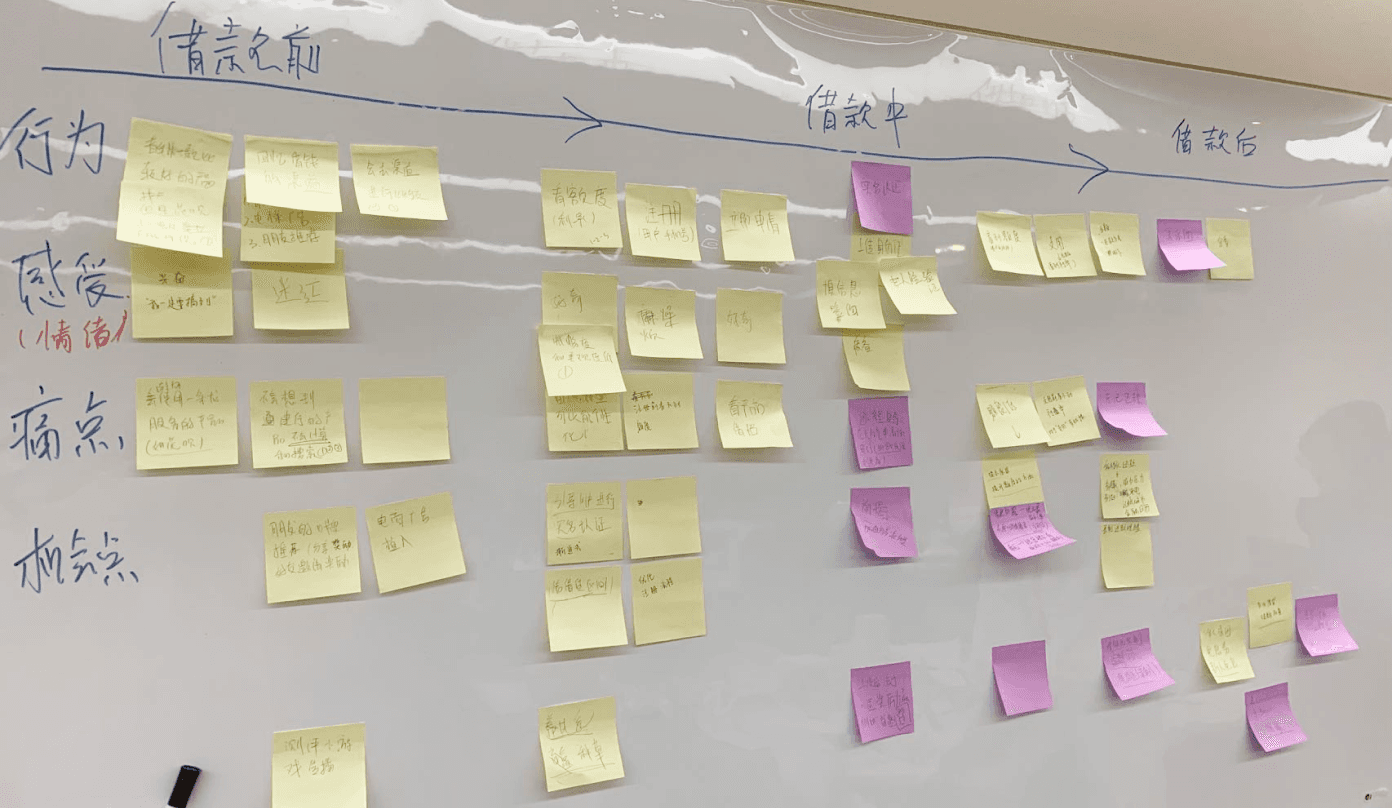

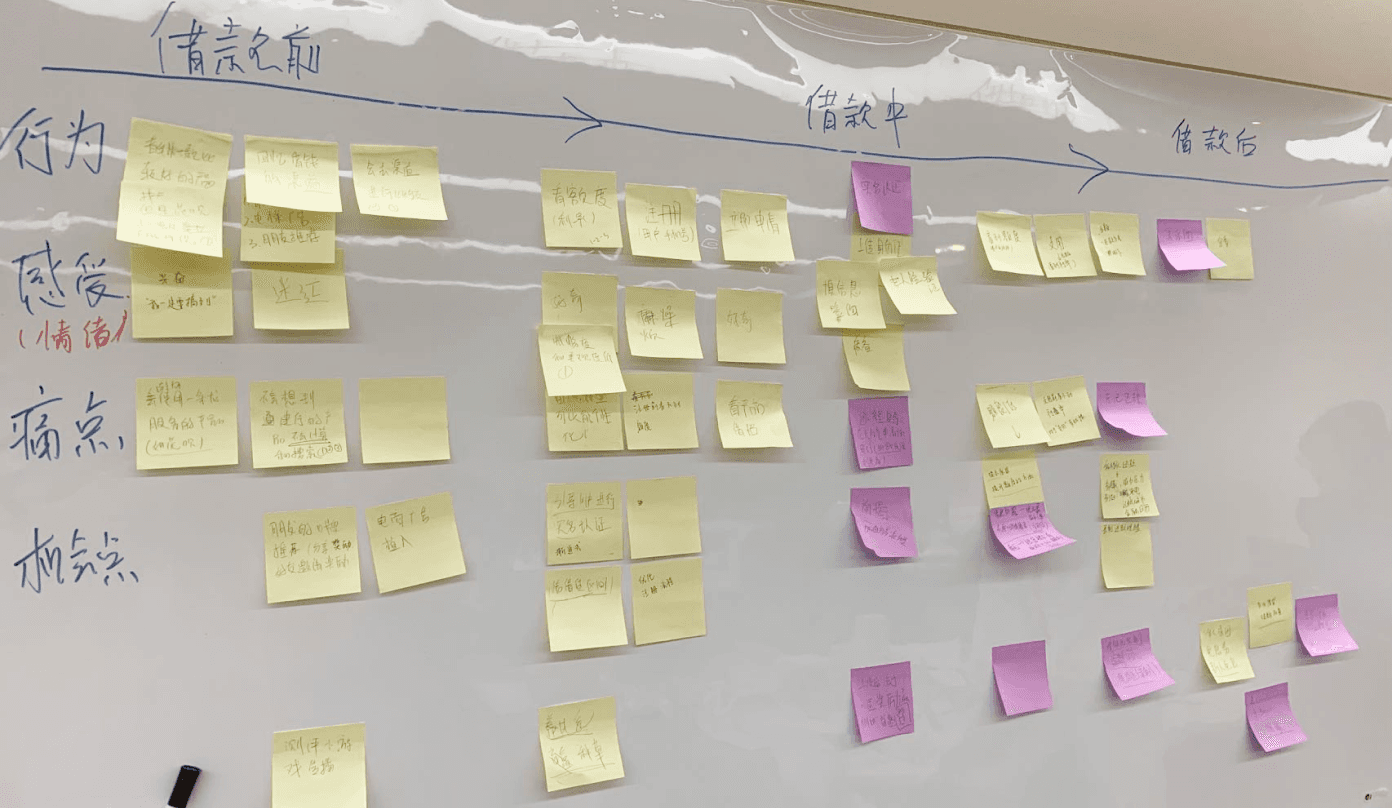

Since I'm responsible for designing multiple projects simultaneously, upon joining this project team, the design workshops and user research had already concluded. Therefore, I need to extract key information from the existing materials to guide my subsequent design efforts.

Since I'm responsible for designing multiple projects simultaneously, upon joining this project team, the design workshops and user research had already concluded. Therefore, I need to extract key information from the existing materials to guide my subsequent design efforts.

Stakeholders Workshop

“We are a well-established state-owned enterprise with a strong foundation of trust and a substantial user base, which are our key strengths. However, the traditional banking DNA also brings with it certain stereotypes, such as a design language that makes it challenging for our products to resonate with younger audiences. In this project, we aim to innovate and break through these conventional banking norms to create a bank product that is more closely aligned with the needs and preferences of our users.”

Strength

State-owned

Substantial user base

Brand assets

Weakness

Ambiguous Design Language

Lack of Clear Product Positioning

Tight Project Timeline and Budget

Expectation

Inspiring CCB Team

Having a memory of the product

A New and Unified Design

Focused on attracting, converting, and retaining potential customers

Stakeholders Workshop

“We are a well-established state-owned enterprise with a strong foundation of trust and a substantial user base, which are our key strengths. However, the traditional banking DNA also brings with it certain stereotypes, such as a design language that makes it challenging for our products to resonate with younger audiences. In this project, we aim to innovate and break through these conventional banking norms to create a bank product that is more closely aligned with the needs and preferences of our users.”

Strength

State-owned

Substantial user base

Brand assets

Weakness

Ambiguous Design Language

Lack of Clear Product Positioning

Tight Project Timeline and Budget

Expectation

Inspiring CCB Team

Having a memory of the product

A New and Unified Design

Focused on attracting, converting, and retaining potential customers

Stakeholders Workshop

“We are a well-established state-owned enterprise with a strong foundation of trust and a substantial user base, which are our key strengths. However, the traditional banking DNA also brings with it certain stereotypes, such as a design language that makes it challenging for our products to resonate with younger audiences. In this project, we aim to innovate and break through these conventional banking norms to create a bank product that is more closely aligned with the needs and preferences of our users.”

Strength

State-owned

Substantial user base

Brand assets

Weakness

Ambiguous Design Language

Lack of Clear Product Positioning

Tight Project Timeline and Budget

Expectation

Inspiring CCB Team

Having a memory of the product

A New and Unified Design

Focused on attracting, converting, and retaining potential customers

Stakeholders Workshop

“We are a well-established state-owned enterprise with a strong foundation of trust and a substantial user base, which are our key strengths. However, the traditional banking DNA also brings with it certain stereotypes, such as a design language that makes it challenging for our products to resonate with younger audiences. In this project, we aim to innovate and break through these conventional banking norms to create a bank product that is more closely aligned with the needs and preferences of our users.”

Strength

State-owned

Substantial user base

Brand assets

Weakness

Ambiguous Design Language

Lack of Clear Product Positioning

Tight Project Timeline and Budget

Expectation

Inspiring CCB Team

Having a memory of the product

A New and Unified Design

Focused on attracting, converting, and retaining potential customers

User Research Analysis

In collaboration with the interaction designers on our team, I extracted three key design elements through the analysis of personas and critical scenarios. These three elements will be pivotal focal points in my upcoming explorations of design direction

Anxiety

Emotion

Anxiety in financial platforms often stems from a lack of trust in the platform, insufficient financial knowledge, and uncertainty about one's own spending capabilities. These factors indeed pose significant barriers to attracting new users to the platform.

Addressing these issues through building trust, providing financial education, and helping users understand their spending capacity can greatly enhance user acquisition and retention.

Complexity

Operation

For users without immediate financial needs, a trial attitude often prevails during the application process. Cumbersome steps can become pivotal reasons for them to abandon the process. For those with a definite need for funds, a complicated process can be a critical factor in deciding whether to choose our services.

Simplifying and clarifying the application process could greatly enhance user experience and decision-making for both user types, thereby increasing conversion rates and user satisfaction in our consumer finance platform

Utilization

Motivation

The fact that consumption is their primary motivator indicates a clear opportunity for engagement strategies.

Focusing on how, why, and where they use financial services can indeed drive new user acquisition and enhance existing user loyalty.

Tailoring services and marketing efforts to align with their lifestyle and consumption patterns, and offering relevant deals and trend-based incentives, could effectively attract this demographic and encourage their continued engagement with the platform.

User Research Analysis

In collaboration with the interaction designers on our team, I extracted three key design elements through the analysis of personas and critical scenarios. These three elements will be pivotal focal points in my upcoming explorations of design direction

Anxiety

Emotion

Anxiety in financial platforms often stems from a lack of trust in the platform, insufficient financial knowledge, and uncertainty about one's own spending capabilities. These factors indeed pose significant barriers to attracting new users to the platform.

Addressing these issues through building trust, providing financial education, and helping users understand their spending capacity can greatly enhance user acquisition and retention.

Complexity

Operation

For users without immediate financial needs, a trial attitude often prevails during the application process. Cumbersome steps can become pivotal reasons for them to abandon the process. For those with a definite need for funds, a complicated process can be a critical factor in deciding whether to choose our services.

Simplifying and clarifying the application process could greatly enhance user experience and decision-making for both user types, thereby increasing conversion rates and user satisfaction in our consumer finance platform

Utilization

Motivation

The fact that consumption is their primary motivator indicates a clear opportunity for engagement strategies.

Focusing on how, why, and where they use financial services can indeed drive new user acquisition and enhance existing user loyalty.

Tailoring services and marketing efforts to align with their lifestyle and consumption patterns, and offering relevant deals and trend-based incentives, could effectively attract this demographic and encourage their continued engagement with the platform.

User Research Analysis

In collaboration with the interaction designers on our team, I extracted three key design elements through the analysis of personas and critical scenarios. These three elements will be pivotal focal points in my upcoming explorations of design direction

Anxiety

Emotion

Anxiety in financial platforms often stems from a lack of trust in the platform, insufficient financial knowledge, and uncertainty about one's own spending capabilities. These factors indeed pose significant barriers to attracting new users to the platform.

Addressing these issues through building trust, providing financial education, and helping users understand their spending capacity can greatly enhance user acquisition and retention.

Complexity

Operation

For users without immediate financial needs, a trial attitude often prevails during the application process. Cumbersome steps can become pivotal reasons for them to abandon the process. For those with a definite need for funds, a complicated process can be a critical factor in deciding whether to choose our services.

Simplifying and clarifying the application process could greatly enhance user experience and decision-making for both user types, thereby increasing conversion rates and user satisfaction in our consumer finance platform

Utilization

Motivation

The fact that consumption is their primary motivator indicates a clear opportunity for engagement strategies.

Focusing on how, why, and where they use financial services can indeed drive new user acquisition and enhance existing user loyalty.

Tailoring services and marketing efforts to align with their lifestyle and consumption patterns, and offering relevant deals and trend-based incentives, could effectively attract this demographic and encourage their continued engagement with the platform.

User Research Analysis

In collaboration with the interaction designers on our team, I extracted three key design elements through the analysis of personas and critical scenarios. These three elements will be pivotal focal points in my upcoming explorations of design direction

Anxiety

Emotion

Anxiety in financial platforms often stems from a lack of trust in the platform, insufficient financial knowledge, and uncertainty about one's own spending capabilities. These factors indeed pose significant barriers to attracting new users to the platform.

Addressing these issues through building trust, providing financial education, and helping users understand their spending capacity can greatly enhance user acquisition and retention.

Complexity

Operation

For users without immediate financial needs, a trial attitude often prevails during the application process. Cumbersome steps can become pivotal reasons for them to abandon the process. For those with a definite need for funds, a complicated process can be a critical factor in deciding whether to choose our services.

Simplifying and clarifying the application process could greatly enhance user experience and decision-making for both user types, thereby increasing conversion rates and user satisfaction in our consumer finance platform

Utilization

Motivation

The fact that consumption is their primary motivator indicates a clear opportunity for engagement strategies.

Focusing on how, why, and where they use financial services can indeed drive new user acquisition and enhance existing user loyalty.

Tailoring services and marketing efforts to align with their lifestyle and consumption patterns, and offering relevant deals and trend-based incentives, could effectively attract this demographic and encourage their continued engagement with the platform.

Our Design should ensure personalized touchpoints, offer a clear and simple application process with effective support, and provide straightforward results feedback, and stress reduction solutions.

Our Design should ensure personalized touchpoints, offer a clear and simple application process with effective support, and provide straightforward results feedback, and stress reduction solutions.

Product Analysis

We conducted research along two dimensions: same category, and same user, different categories. Through this comparative analysis, we aimed to find features with the most potential that align with our target audience and product positioning

Key Findings

#Emotion

Brand personification

In an era where app designs are becoming increasingly homogenized, leveraging brand character personification can effectively establish brand differentiation.

By interacting with users through a cute and friendly character, an emotional connection is built, bridging the gap between the platform and its users. This approach, compared to traditional text and image formats, can alleviate the feelings of unfamiliarity and anxiety often experienced during initial usage.

#Motivation

Online community

Banking apps are increasingly focusing on online community engagement, such as by initiating popular topic challenges to stimulate user participation, thereby enhancing user stickiness. However, this approach may not be suitable for our first version. Community-oriented operations require higher costs and may struggle to achieve differentiation. Instead, at this stage, we should prioritize acquiring new users.

#Emotion

Gamify personal report

creative test reports reflecting data have become popular in Chinese apps, especially among the younger generation. The popularity of such reports essentially reflects individuals' desire to create specific symbols in the digital space to gain recognition from others and shape their personal identity. This approach can aid early-stage products in gaining traction on social media, thereby attracting more potential users.

#Motivation

Content Seeding

It involves creating engaging and valuable content to subtly promote a product or service idea. This content typically revolves around lifestyle, trends, or user interests, aiming to spark curiosity and interest in the audience, thereby encouraging them to explore and potentially purchase the promoted product or service. Through content seeding, brands can organically build awareness and trust within their target audience without resorting to direct sales tactics.

Instead of just being another financial tool app, why not transform it into a friend who understands finance for the user?

Define Features

Through workshop sessions, we began categorizing functions based on feasibility and value, contemplating how to acquire, activate, retain, and refer users (AARRR framework). Based on these considerations, we planned the key page structures for the 1.0 version.

Our platform forms a comprehensive experience cycle that starts with a chance discovery in our Home page, progresses through engaging with our interest-based Shop and Content, extends to utilizing our lending services, and culminates with exclusive member benefits. This cycle seamlessly guides users from initial interest to lasting memories.

Product Analysis

We conducted research along two dimensions: same category, and same user, different categories. Through this comparative analysis, we aimed to find features with the most potential that align with our target audience and product positioning

Key Findings

#Emotion

Brand personification

In an era where app designs are becoming increasingly homogenized, leveraging brand character personification can effectively establish brand differentiation.

By interacting with users through a cute and friendly character, an emotional connection is built, bridging the gap between the platform and its users. This approach, compared to traditional text and image formats, can alleviate the feelings of unfamiliarity and anxiety often experienced during initial usage.

#Motivation

Online community

Banking apps are increasingly focusing on online community engagement, such as by initiating popular topic challenges to stimulate user participation, thereby enhancing user stickiness. However, this approach may not be suitable for our first version. Community-oriented operations require higher costs and may struggle to achieve differentiation. Instead, at this stage, we should prioritize acquiring new users.

#Emotion

Gamify personal report

creative test reports reflecting data have become popular in Chinese apps, especially among the younger generation. The popularity of such reports essentially reflects individuals' desire to create specific symbols in the digital space to gain recognition from others and shape their personal identity. This approach can aid early-stage products in gaining traction on social media, thereby attracting more potential users.

#Motivation

Content Seeding

It involves creating engaging and valuable content to subtly promote a product or service idea. This content typically revolves around lifestyle, trends, or user interests, aiming to spark curiosity and interest in the audience, thereby encouraging them to explore and potentially purchase the promoted product or service. Through content seeding, brands can organically build awareness and trust within their target audience without resorting to direct sales tactics.

Instead of just being another financial tool app, why not transform it into a friend who understands finance for the user?

Define Features

Through workshop sessions, we began categorizing functions based on feasibility and value, contemplating how to acquire, activate, retain, and refer users (AARRR framework). Based on these considerations, we planned the key page structures for the 1.0 version.

Our platform forms a comprehensive experience cycle that starts with a chance discovery in our Home page, progresses through engaging with our interest-based Shop and Content, extends to utilizing our lending services, and culminates with exclusive member benefits. This cycle seamlessly guides users from initial interest to lasting memories.

Product Analysis

We conducted research along two dimensions: same category, and same user, different categories. Through this comparative analysis, we aimed to find features with the most potential that align with our target audience and product positioning

Key Findings

#Emotion

Brand personification

In an era where app designs are becoming increasingly homogenized, leveraging brand character personification can effectively establish brand differentiation.

By interacting with users through a cute and friendly character, an emotional connection is built, bridging the gap between the platform and its users. This approach, compared to traditional text and image formats, can alleviate the feelings of unfamiliarity and anxiety often experienced during initial usage.

#Motivation

Online community

Banking apps are increasingly focusing on online community engagement, such as by initiating popular topic challenges to stimulate user participation, thereby enhancing user stickiness. However, this approach may not be suitable for our first version. Community-oriented operations require higher costs and may struggle to achieve differentiation. Instead, at this stage, we should prioritize acquiring new users.

#Emotion

Gamify personal report

creative test reports reflecting data have become popular in Chinese apps, especially among the younger generation. The popularity of such reports essentially reflects individuals' desire to create specific symbols in the digital space to gain recognition from others and shape their personal identity. This approach can aid early-stage products in gaining traction on social media, thereby attracting more potential users.

#Motivation

Content Seeding

It involves creating engaging and valuable content to subtly promote a product or service idea. This content typically revolves around lifestyle, trends, or user interests, aiming to spark curiosity and interest in the audience, thereby encouraging them to explore and potentially purchase the promoted product or service. Through content seeding, brands can organically build awareness and trust within their target audience without resorting to direct sales tactics.

Instead of just being another financial tool app, why not transform it into a friend who understands finance for the user?

Define Features

Through workshop sessions, we began categorizing functions based on feasibility and value, contemplating how to acquire, activate, retain, and refer users (AARRR framework). Based on these considerations, we planned the key page structures for the 1.0 version.

Our platform forms a comprehensive experience cycle that starts with a chance discovery in our Home page, progresses through engaging with our interest-based Shop and Content, extends to utilizing our lending services, and culminates with exclusive member benefits. This cycle seamlessly guides users from initial interest to lasting memories.

Product Analysis

We conducted research along two dimensions: same category, and same user, different categories. Through this comparative analysis, we aimed to find features with the most potential that align with our target audience and product positioning

Key Findings

#Emotion

Brand personification

In an era where app designs are becoming increasingly homogenized, leveraging brand character personification can effectively establish brand differentiation.

By interacting with users through a cute and friendly character, an emotional connection is built, bridging the gap between the platform and its users. This approach, compared to traditional text and image formats, can alleviate the feelings of unfamiliarity and anxiety often experienced during initial usage.

#Motivation

Online community

Banking apps are increasingly focusing on online community engagement, such as by initiating popular topic challenges to stimulate user participation, thereby enhancing user stickiness. However, this approach may not be suitable for our first version. Community-oriented operations require higher costs and may struggle to achieve differentiation. Instead, at this stage, we should prioritize acquiring new users.

#Emotion

Gamify personal report

creative test reports reflecting data have become popular in Chinese apps, especially among the younger generation. The popularity of such reports essentially reflects individuals' desire to create specific symbols in the digital space to gain recognition from others and shape their personal identity. This approach can aid early-stage products in gaining traction on social media, thereby attracting more potential users.

#Motivation

Content Seeding

It involves creating engaging and valuable content to subtly promote a product or service idea. This content typically revolves around lifestyle, trends, or user interests, aiming to spark curiosity and interest in the audience, thereby encouraging them to explore and potentially purchase the promoted product or service. Through content seeding, brands can organically build awareness and trust within their target audience without resorting to direct sales tactics.

Instead of just being another financial tool app, why not transform it into a friend who understands finance for the user?

Define Features

Through workshop sessions, we began categorizing functions based on feasibility and value, contemplating how to acquire, activate, retain, and refer users (AARRR framework). Based on these considerations, we planned the key page structures for the 1.0 version.

Our platform forms a comprehensive experience cycle that starts with a chance discovery in our Home page, progresses through engaging with our interest-based Shop and Content, extends to utilizing our lending services, and culminates with exclusive member benefits. This cycle seamlessly guides users from initial interest to lasting memories.

Exploration of Visual Design

Understand

In the first phase, we conducted desktop research, and stakeholder interviews to understand key aspects of the brand strategy, extracted keywords from user research to identify target user preferences, and combined them with established product design principles to define the visual design keywords.

The slogan of CCB is "Creating a Better Future."

So, what kind of future does CCB envision?

Exploration of Visual Design

Exploration

In the first phase, we conducted desktop research, and stakeholder interviews to understand key aspects of the brand strategy, extracted keywords from user research to identify target user preferences, and combined them with established product design principles to define the visual design keywords.

The future of CCB products is to be more Trustworthy, Clarity and Emotionally engaging.

A Financially Savvy Friend

Utilizing IP Characters, we aim to create a companionable, warm, and trustworthy consumption platform. Let users feel more like a chat with a friend than a traditional service.

Home

The design of the homepage focuses more on the concept that our system's product is a friend to the user. Unlike other platforms that merely display product content, we personify our brand and engage in dialogues with users, inviting them to become our friends.

Shop

The design of the shop is tailored to the characteristics and behaviors of users. Our research indicates that consumer finance users are more concerned with areas of personal interest, more inclined to explore cost-effective products, and prefer shopping through installment payments

Find

While the gifting culture in China is an integral part of the country's traditions and values, it also poses challenges for many young Chinese people. To address this issue, we have developed a page specifically focused on gifting culture. By integrating it with our e-commerce products, we aim to increase product click-through and conversion rates, stimulate loan demands, and ultimately boost the conversion of new users on the platform. This strategy not only leverages the cultural aspect of gifting to enhance user engagement but also aligns it with our platform's business objectives, creating a win-win scenario

Deliver

I compiled the components used in key pages into a comprehensive component guide and authored a set of basic design guidelines to assist team members and the CCB development team in their subsequent work.

Exploration of Visual Design

Understand

In the first phase, we conducted desktop research, and stakeholder interviews to understand key aspects of the brand strategy, extracted keywords from user research to identify target user preferences, and combined them with established product design principles to define the visual design keywords.

The slogan of CCB is "Creating a Better Future."

So, what kind of future does CCB envision?

Exploration of Visual Design

Exploration

In the first phase, we conducted desktop research, and stakeholder interviews to understand key aspects of the brand strategy, extracted keywords from user research to identify target user preferences, and combined them with established product design principles to define the visual design keywords.

The future of CCB products is to be more Trustworthy, Clarity and Emotionally engaging.

A Financially Savvy Friend

Utilizing IP Characters, we aim to create a companionable, warm, and trustworthy consumption platform. Let users feel more like a chat with a friend than a traditional service.

Home

The design of the homepage focuses more on the concept that our system's product is a friend to the user. Unlike other platforms that merely display product content, we personify our brand and engage in dialogues with users, inviting them to become our friends.

Shop

The design of the shop is tailored to the characteristics and behaviors of users. Our research indicates that consumer finance users are more concerned with areas of personal interest, more inclined to explore cost-effective products, and prefer shopping through installment payments

Find

While the gifting culture in China is an integral part of the country's traditions and values, it also poses challenges for many young Chinese people. To address this issue, we have developed a page specifically focused on gifting culture. By integrating it with our e-commerce products, we aim to increase product click-through and conversion rates, stimulate loan demands, and ultimately boost the conversion of new users on the platform. This strategy not only leverages the cultural aspect of gifting to enhance user engagement but also aligns it with our platform's business objectives, creating a win-win scenario

Deliver

I compiled the components used in key pages into a comprehensive component guide and authored a set of basic design guidelines to assist team members and the CCB development team in their subsequent work.

Exploration of Visual Design

Understand

In the first phase, we conducted desktop research, and stakeholder interviews to understand key aspects of the brand strategy, extracted keywords from user research to identify target user preferences, and combined them with established product design principles to define the visual design keywords.

The slogan of CCB is "Creating a Better Future."

So, what kind of future does CCB envision?

Exploration of Visual Design

Exploration

In the first phase, we conducted desktop research, and stakeholder interviews to understand key aspects of the brand strategy, extracted keywords from user research to identify target user preferences, and combined them with established product design principles to define the visual design keywords.

The future of CCB products is to be more Trustworthy, Clarity and Emotionally engaging.

A Financially Savvy Friend

Utilizing IP Characters, we aim to create a companionable, warm, and trustworthy consumption platform. Let users feel more like a chat with a friend than a traditional service.

Home

The design of the homepage focuses more on the concept that our system's product is a friend to the user. Unlike other platforms that merely display product content, we personify our brand and engage in dialogues with users, inviting them to become our friends.

Shop

The design of the shop is tailored to the characteristics and behaviors of users. Our research indicates that consumer finance users are more concerned with areas of personal interest, more inclined to explore cost-effective products, and prefer shopping through installment payments

Find

While the gifting culture in China is an integral part of the country's traditions and values, it also poses challenges for many young Chinese people. To address this issue, we have developed a page specifically focused on gifting culture. By integrating it with our e-commerce products, we aim to increase product click-through and conversion rates, stimulate loan demands, and ultimately boost the conversion of new users on the platform. This strategy not only leverages the cultural aspect of gifting to enhance user engagement but also aligns it with our platform's business objectives, creating a win-win scenario

Deliver

I compiled the components used in key pages into a comprehensive component guide and authored a set of basic design guidelines to assist team members and the CCB development team in their subsequent work.

Exploration of Visual Design

Understand

In the first phase, we conducted desktop research, and stakeholder interviews to understand key aspects of the brand strategy, extracted keywords from user research to identify target user preferences, and combined them with established product design principles to define the visual design keywords.

The slogan of CCB is "Creating a Better Future."

So, what kind of future does CCB envision?

Exploration of Visual Design

Exploration

In the first phase, we conducted desktop research, and stakeholder interviews to understand key aspects of the brand strategy, extracted keywords from user research to identify target user preferences, and combined them with established product design principles to define the visual design keywords.

The future of CCB products is to be more Trustworthy, Clarity and Emotionally engaging.

A Financially Savvy Friend

Utilizing IP Characters, we aim to create a companionable, warm, and trustworthy consumption platform. Let users feel more like a chat with a friend than a traditional service.

Home

The design of the homepage focuses more on the concept that our system's product is a friend to the user. Unlike other platforms that merely display product content, we personify our brand and engage in dialogues with users, inviting them to become our friends.

Shop

The design of the shop is tailored to the characteristics and behaviors of users. Our research indicates that consumer finance users are more concerned with areas of personal interest, more inclined to explore cost-effective products, and prefer shopping through installment payments

Find

While the gifting culture in China is an integral part of the country's traditions and values, it also poses challenges for many young Chinese people. To address this issue, we have developed a page specifically focused on gifting culture. By integrating it with our e-commerce products, we aim to increase product click-through and conversion rates, stimulate loan demands, and ultimately boost the conversion of new users on the platform. This strategy not only leverages the cultural aspect of gifting to enhance user engagement but also aligns it with our platform's business objectives, creating a win-win scenario

Deliver

I compiled the components used in key pages into a comprehensive component guide and authored a set of basic design guidelines to assist team members and the CCB development team in their subsequent work.

Lookback

Reflecting on this project under tight deadlines, I learned the importance of agility and adaptability in product design, especially in a resource-constrained environment.

The transition to remote work and frequent team changes highlighted the necessity of a well-structured design team and robust documentation. I developed skills in prioritizing design elements and streamlining review processes, ensuring consistency despite the challenges. This experience reinforced the value of agile methodologies and co-creation workshops for efficient innovation and taught me the significance of internal alignment and clear communication in managing dynamic project scenarios.

These learnings have been instrumental in enhancing my approach to design and team collaboration.

Reflecting on this project under tight deadlines, I learned the importance of agility and adaptability in product design, especially in a resource-constrained environment.

The transition to remote work and frequent team changes highlighted the necessity of a well-structured design team and robust documentation. I developed skills in prioritizing design elements and streamlining review processes, ensuring consistency despite the challenges. This experience reinforced the value of agile methodologies and co-creation workshops for efficient innovation and taught me the significance of internal alignment and clear communication in managing dynamic project scenarios.

These learnings have been instrumental in enhancing my approach to design and team collaboration.

Looking Ahead

Successfully guiding China Construction Bank in launching their 1.0 consumer finance platform, we have validated our foresight in digital banking trends, particularly with the industry's shift towards anthropomorphized AI and conversational interfaces in 2023. Our initial vision to revolutionize app interfaces with engaging IP characters for transaction facilitation has set a precedent. Moving forward, we aim to persist in this innovative trajectory, shaping the future of digital banking experiences.Design core pages for both mobile and brand business website.

Successfully guiding China Construction Bank in launching their 1.0 consumer finance platform, we have validated our foresight in digital banking trends, particularly with the industry's shift towards anthropomorphized AI and conversational interfaces in 2023. Our initial vision to revolutionize app interfaces with engaging IP characters for transaction facilitation has set a precedent. Moving forward, we aim to persist in this innovative trajectory, shaping the future of digital banking experiences.Design core pages for both mobile and brand business website.